Understanding Crypto Correlation Analysis: Investor’s Guide

With the cryptocurrency market experiencing a staggering turnover of approximately $2.5 trillion in trading volume in 2023, understanding crypto correlation analysis becomes essential for investors looking to optimize their portfolios. As a dynamic and fast-paced landscape, the correlations among various digital assets provide investors with insights into market behaviors and potential opportunities for maximizing returns.

What is Crypto Correlation Analysis?

Crypto correlation analysis studies the relationship between the price movements of different cryptocurrencies. By understanding these correlations, investors can make informed decisions about diversification, risk management, and overall investment strategies.

In simpler terms, if one cryptocurrency’s price changes, a correlated asset might change in a similar way. This relationship can be quantified using correlation coefficients, which range from -1 to +1. A coefficient of +1 indicates perfect positive correlation, -1 indicates perfect negative correlation, and 0 indicates no correlation.

Examples and Types of Correlations

- Positive Correlation: Bitcoin (BTC) and Ethereum (ETH) often show this type of correlation, meaning if Bitcoin’s price rises, Ethereum’s price is likely to rise as well.

- Negative Correlation: Some altcoins may demonstrate negative correlations with Bitcoin. For instance, if Bitcoin’s market cap increases, some smaller coins may experience price drops due to a shift in investor focus.

- Neutral Correlation: Stablecoins, such as Tether (USDT), often show little to no correlation with other cryptocurrencies as their value is pegged to fiat currencies.

This categorization helps investors understand how different assets react under varying market conditions.

Why is Crypto Correlation Analysis Essential for Investors?

Investors often seek ways to manage risks associated with the volatile nature of cryptocurrencies. The significance of correlation analysis becomes evident when assessing the following aspects:

1. Portfolio Diversification

By understanding the correlations between different assets, investors can create diversified portfolios to mitigate risks. For example, if assets are positively correlated, losing positions may lead to higher risk. However, mixing negatively correlated assets could balance the losses.

2. Enhanced Risk Management

Investors can identify potential risks by analyzing correlations and adjust their exposure to specific cryptocurrencies. This approach is particularly effective during market downturns, allowing investors to protect their portfolios.

3. Improved Investment Strategies

Through correlation analysis, traders can leverage broad trends. For example, if historical analysis reveals that a particular pair of coins performs well in certain market conditions, strategizing could yield higher returns.

As an example, consider the Vietnamese market, where the number of crypto users has increased by over 35% in the last year. Local investors are now turning to advanced strategies based on correlation analysis, understanding how global trends affect their investments.

Key Tools for Crypto Correlation Analysis

Several tools and platforms can assist in performing crypto correlation analysis. Each comes with its unique set of features to cater to specific needs:

- CoinMetrics: Offers various metrics for cryptocurrency data analysis, including correlation coefficients.

- TradingView: Provides charting tools that enable users to visualize correlations over time.

- CryptoCompare: Offers a wide range of data, including historical price movements necessary for correlation studies.

Using these tools can give you an edge in understanding market dynamics.

How to Perform Crypto Correlation Analysis

Let’s break down the steps to perform crypto correlation analysis effectively:

1. Collect Data

Start by gathering historical price data for the cryptocurrencies you’re interested in. This data can be retrieved from various APIs including CoinMarketCap and others.

2. Calculate Correlation Coefficient

Using statistical software or online calculators, compute the correlation coefficient for the selected cryptocurrencies based on their historical price movements. You can employ spreadsheet software like Excel or R for more complex datasets.

3. Visualization

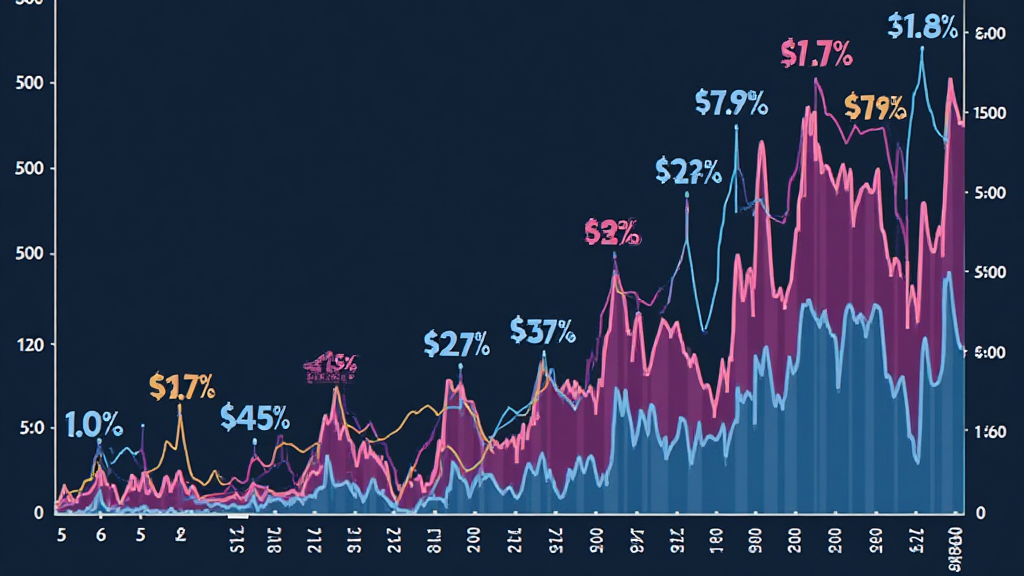

Utilize charts and graphs to visualize the correlations. Visual tools will help you identify trends and correlations more effectively.

The Impact of Global Events on Correlation

Understanding correlation effects during significant events is crucial for anticipating market responses. Global news such as regulatory changes, technological advancements, or market crashes can influence correlations significantly.

For example, during the 2022 crypto crash, many assets correlated closely, illustrating the growing interdependence of cryptocurrencies. Their price movements mirrored each other due to heightened market fear and uncertainty.

Future Trends in Crypto Correlation Analysis

As the cryptocurrency ecosystem evolves, emerging trends in analysis techniques will affect how correlations are interpreted:

- Increased Data Accessibility: With the advancement of blockchain technology, more detailed market data becomes readily accessible to investors, enhancing their ability to perform correlation analysis.

- Integration of AI and Machine Learning: Expect more sophisticated tools utilizing AI algorithms to analyze vast datasets and provide insights that are hard to find through traditional methods.

- Regulatory Impact: As governments like Vietnam continue strengthening tiêu chuẩn an ninh blockchain (blockchain security standards), understanding how legal frameworks affect correlation will become increasingly relevant.

These trends indicate that crypto correlation analysis will play an increasingly vital role in investment strategies moving forward.

Conclusion: Mastering Crypto Correlation Analysis

Understanding crypto correlation analysis equips investors with the insights needed to navigate the complex waters of the cryptocurrency market effectively. By emphasizing diversification and risk management through correlation studies, investors can seize opportunities and safeguard their investments against market volatility.

With more Vietnamese investors looking for smart strategies in the evolving crypto landscape, mastering correlation analysis is imperative for success.

For those interested in exploring further, don’t hesitate to consult our site at bobscoinsonline and delve deeper into crypto strategies and potential opportunities. Not financial advice; always consult with local regulators.

Authored by Dr. Alice Nguyen, a recognized cryptocurrency researcher with published works on blockchain scalability, having led audits for several high-profile ICOs.