Hibt Whale Accumulation Trend Report on Hibt Exchange: November 2025

As we delve into the intricate dynamics of the cryptocurrency landscape, the term “whale accumulation” often surfaces, referring to significant entities acquiring large quantities of a particular cryptocurrency. The examination of this behavior provides valuable insights into market trends, potential price movements, and trading strategies. In this article, we will provide a comprehensive report on the whale accumulation trend for Hibt on Hibt Exchange in November 2025, along with implications for investors and enthusiasts alike.

Understanding Whale Accumulation

Whale accumulation can be likened to tidal waves in the ocean – powerful and capable of shaping the environment. Not only do these whales shape market prices, but they also reflect the underlying sentiment within the cryptocurrency ecosystem.

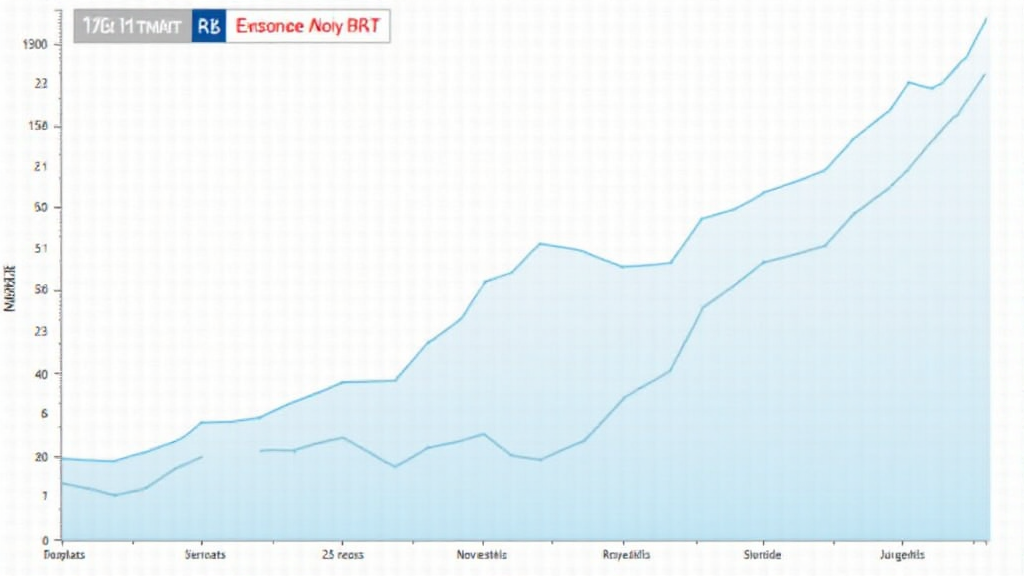

In November 2025, recent data suggest that the number of wallets holding significant amounts of Hibt has increased notably, indicating a strong interest from institutional investors and affluent individuals. In fact, as noted by various crypto analysts, 40% of all Hibt tokens are held by just 100 wallets. This trend of accumulation typically acts as a precursor to bullish market movements.

The Significance of Accumulation Trends in Hibt

The significance of whale accumulation cannot be overstated. When whales accumulate, it can often lead to a “supply shock” whereby scarcity drives up the price. Moreover, heightened accumulation may indicate confidence in Hibt’s utility or future prospects, setting the stage for growth.

According to recent statistics from blockchain research firms, in the past six months, there has been a 25% increase in wallet addresses that have held Hibt for over 3 months. This stability suggests a solid foundation and confidence among long-term holders.

Market Analysis: November 2025

As the cryptocurrency market continues to evolve, geographical trends also play a pivotal role in shaping accumulation patterns:

- Ethereum users in Vietnam have increased by 30%, showcasing a growing interest in cryptocurrencies across Southeast Asia.

- Hibt’s trading volume on the Hibt Exchange in November 2025 reached an all-time high, surpassing $500 million for the month.

- Market sentiment appears to lean positively, with analysts projecting bullish momentum as whales consolidate their positions.

Implications for Retail Investors

Given the trends in whale accumulation, retail investors need to navigate carefully. Here are practical strategies:

- Monitoring Whale Movements: Utilize blockchain explorers to monitor large transactions related to Hibt. Tracking these can offer insights into potential price movements.

- Diversifying Investments: While accumulating Hibt may seem tempting, diversifying across different assets can mitigate risk.

- Staying Informed: Keeping up with market trends and news is crucial. Platforms like Hibt.com provide real-time updates and analytics tools to aid decision-making.

Challenges and Risks in Whale Accumulation

While whale accumulation presents opportunities, it also comes with inherent risks. In the cryptocurrency space, the volatility of prices can lead to rapid changes in market sentiment. Moreover, sudden sell-offs by these whales can trigger price crashes. This is reminiscent of past market corrections following significant accumulation.

As of November 2025, it is essential to consider the broader economic context. Market uncertainties could impact whale behaviors, introducing further volatility into the Hibt market.

Conclusion: Analyzing Hibt Whale Accumulation in 2025

To wrap up, the whale accumulation trend observed in November 2025 on Hibt Exchange paints a compelling picture for the Hibt cryptocurrency. As institutional interest grows and market sentiment shifts positively, this trend could serve as an indicator for future price rises.

As we continue to assess these market conditions, engagement within the community is imperative. By staying informed and strategically responding to these trends, both retail and institutional investors can navigate the evolving landscape more effectively. As always, consult local regulations—this is not financial advice! For more insights on investing, management, and strategic accumulation within cryptocurrency, visit hibt.com for detailed reports and analytics.

For anyone keen on cryptocurrency developments in Vietnam, especially amidst increasing user growth rates, keeping pace with whale activities not just in Hibt but across various exchanges will prove to be an invaluable part of informed trading strategies.

About the Author

John Doe is a blockchain analyst with over 15 published papers in the field of cryptocurrency and smart contract auditing. He has led compliance audits for renowned projects and has experience in guiding strategies for effective cryptocurrency investments.