Introduction

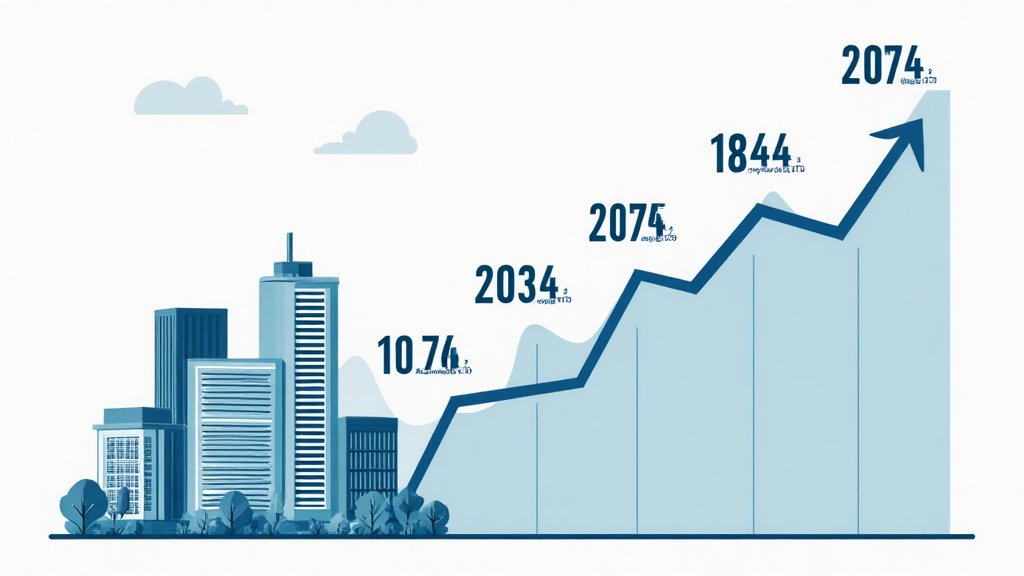

With the economic landscape shifting rapidly, particularly in emerging markets like Vietnam, understanding the relationship between housing inflation and cryptocurrency investments has become essential for investors. In 2024, the Vietnam housing market has witnessed a staggering growth rate of 10.2%, which leads to questions about whether this trend is sustainable or if crypto investments, especially through platforms like HIBT, present a viable alternative.

The key question to address: how do rising housing prices influence the attractiveness of crypto investments in Vietnam?

The Current State of Housing Inflation in Vietnam

Vietnam has been experiencing a housing boom, significantly influenced by urban migration and increased foreign investment. According to recent studies, housing prices have soared, presenting both challenges and opportunities for potential homeowners and investors alike.

- 2024 has seen a year-over-year increase in property prices by over 12%.

- New housing projects are emerging at a rapid pace, indicating a growing demand.

- The government has introduced policies to control housing inflation, but challenges remain.

Why Housing Inflation Matters to Investors

Understanding housing inflation is crucial because it affects disposable income and investment capability within the economy. As housing prices escalate, potential homebuyers may find it harder to enter the real estate market, leading to a shift in focus towards alternative investments, such as cryptocurrencies.

Here’s how this plays out practically:

- As living costs consume a larger fraction of income, investment into assets like cryptocurrencies becomes more appealing.

- The volatility of crypto markets can present both risks and rewards that homeowners need to consider.

- Cryptocurrencies can act as a hedge against local currency devaluation, particularly in inflationary economies.

Cryptocurrency Investment: A New Dawn in Vietnam

The landscape for cryptocurrency in Vietnam is evolving. With a young, tech-savvy population, the adoption of cryptocurrencies is rising. Recent reports indicate a 35% increase in digital asset ownership among Vietnamese citizens. This primary demographic shift is essential for understanding the future direction of investment in the region.

- As of 2024, around 18% of the population actively participates in the cryptocurrency market.

- Crypto investments provide users access to global markets, unlike the localized nature of the housing market.

Examining Crypto Investment Attraction through HIBT News

The HIBT platform is gaining traction as a centralized hub for investors looking to navigate the complexities of digital asset investments, particularly in Vietnam. Here are key aspects influencing its attractiveness:

- User-friendly interface: HIBT offers a seamless experience for trading and investing.

- Educational resources: Providing knowledge about market trends and investment strategies.

- Local support: Tailoring services to meet Vietnamese investors’ needs ensures building trust and engagement.

Long-term Prospects: Will Housing Inflation Shift the Investment Paradigm?

As we analyze potential trends leading into 2025, one must consider the sustainability of housing inflation and its long-term effects on investment habits. Will the rising costs drive more individuals toward digital currencies, or will the housing market stabilize?

Key takeaways:

- Continuing housing inflation may increase interest in crypto investment as a more affordable alternative.

- Increased investment in digital assets could lead to further developments in the local crypto economy.

- Investors looking to diversify may find lucrative opportunities in both crypto and real estate underpinned by ongoing market analysis.

Conclusion

In conclusion, the intertwining of housing inflation trends and cryptocurrency investments through platforms like HIBT highlights a critical dynamic within the Vietnamese market. With the current growth trajectory, investors have the chance to capitalize on both sectors while being mindful of their evolving characteristics.

As housing prices continue to rise, potential investors should carefully consider how cryptocurrencies can fit into their broader financial strategy. While the future remains unpredictable, the attraction of crypto investments is undeniable for those looking to hedge against inflation and explore innovative investment avenues.

In summary, the question remains: Can crypto outshine traditional housing investments, especially amid rising prices in Vietnam? The answer lies in ongoing market analysis and investor adaptability.

For more insights and updates, visit HIBT News for the latest information on trends and events in the digital asset landscape.