Introduction

With the rapidly evolving landscape of cryptocurrency, many investors are faced with choices that could significantly impact their financial outcomes. In 2023 alone, the Vietnamese crypto market has seen a substantial growth rate of 30%, attracting both seasoned investors and beginners alike. Understanding the nuances of various investment vehicles is crucial. In this article, we explore the comparison between Hibt Exchange dividend tokens and staking yields to provide clarity for Vietnamese investors looking to optimize their portfolios and enhance their financial education.

Understanding Dividend Tokens

Dividend tokens, like those found on the Hibt Exchange, provide holders with a share of the profits generated by the platform. These tokens yield returns based on the success and revenue of the exchange.

- Profit Distribution: Dividends are typically distributed quarterly or annually, depending on the exchange.

- Market Performance: The value of dividend tokens can fluctuate based on market conditions.

- Investor Rights: Holding dividend tokens often grants investors a voice in governance, allowing them to vote on crucial decisions.

The Mechanics of Staking

Staking yields, on the other hand, come from locking up a certain number of coins or tokens within a blockchain network to support operations like validating transactions. Over the last year, the popularity of staking in Vietnam has surged by 50% as more investors seek passive income routes.

- Influencing Factors: Factors like network performance and the number of tokens staked can affect yields.

- Reward Schedule: Staking rewards can be distributed daily, weekly, or based on block generation.

- Risk Assessment: Although staking can be lucrative, it also poses risks, including potential slashing of staked tokens due to network issues.

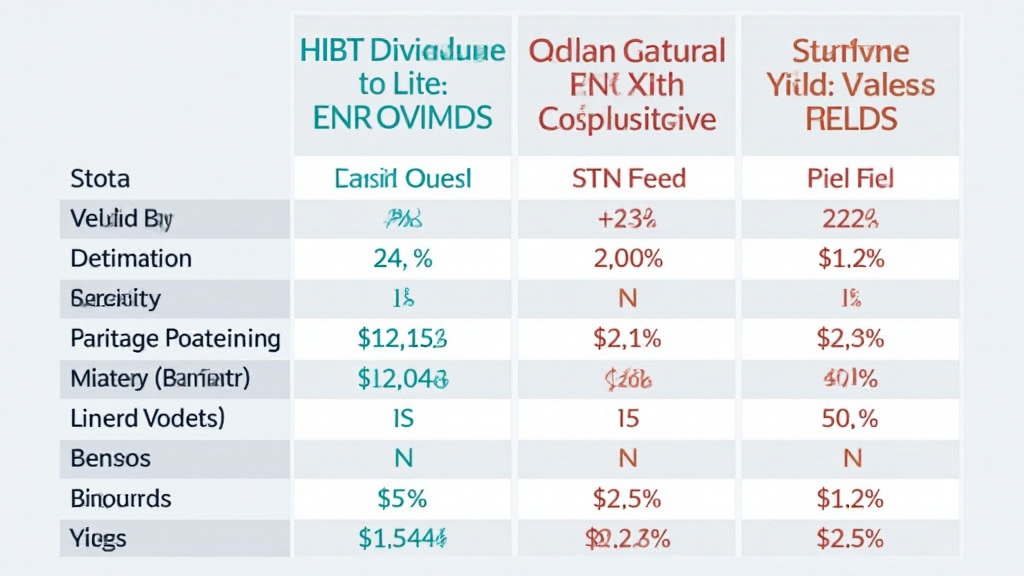

Comparative Analysis of Risks and Rewards

When analyzing Hibt Exchange dividend tokens versus staking yields, investors should consider the following:

Yield Potential

- Hibt Exchange: Historically provides stable returns but is subject to market fluctuations.

- Staking: Potential for higher yields during bullish trends but also comes with increased risk as capital is locked.

Liquidity

- Dividend Tokens: Generally offer more liquidity, allowing for quicker withdrawals or trades.

- Staked Assets: Typically have a vesting period, limiting immediate access to funds.

Educational Insights for Vietnamese Investors

According to industry data, over 70% of Vietnamese crypto investors are hesitant to choose between dividends and staking, primarily due to a lack of understanding. Therefore, education is key.

- Market Workshops: Participate in local workshops to grasp the practical applications of dividend tokens and staking.

- Community Engagement: Join online forums and social media groups focused on Vietnamese crypto discourse.

- Utilize Tools: Consider using decentralized finance (DeFi) tools that simplify staking processes and maximize yield.

Conclusion

In summary, the decision between Hibt Exchange dividend tokens and staking yields comes down to individual risk tolerance, investment strategy, and the specific market conditions at play. By comprehensively evaluating these options, Vietnamese investors can make informed decisions tailored to their financial goals. To fully capitalize on the opportunities in the crypto landscape, continuous education and staying updated with market trends are essential.

This insightful analysis is backed by Jonatan Nguyen, a blockchain security expert with over 15 published papers and numerous audits on top-tier projects, aiming to empower investors in Vietnam and enhancing their understanding of the emerging digital asset space.