Introduction: The Growing Importance of Crypto Technical Analysis

In 2024, the cryptocurrency market saw a staggering $4.1 billion lost due to DeFi hacks. With such immense risks, the importance of crypto technical analysis cannot be overstated. As we approach 2025, investors need to harness every possible tool to safeguard their investments while navigating the volatile market landscape.

This article aims to equip you with effective strategies and insights into crypto technical analysis, enabling you to make informed decisions and maximize your investment potential.

Understanding the Basics of Crypto Technical Analysis

Crypto technical analysis involves examining previous market data, price movements, and volume metrics to forecast future price movements. Think of it as reading the pulse of the cryptocurrency market.

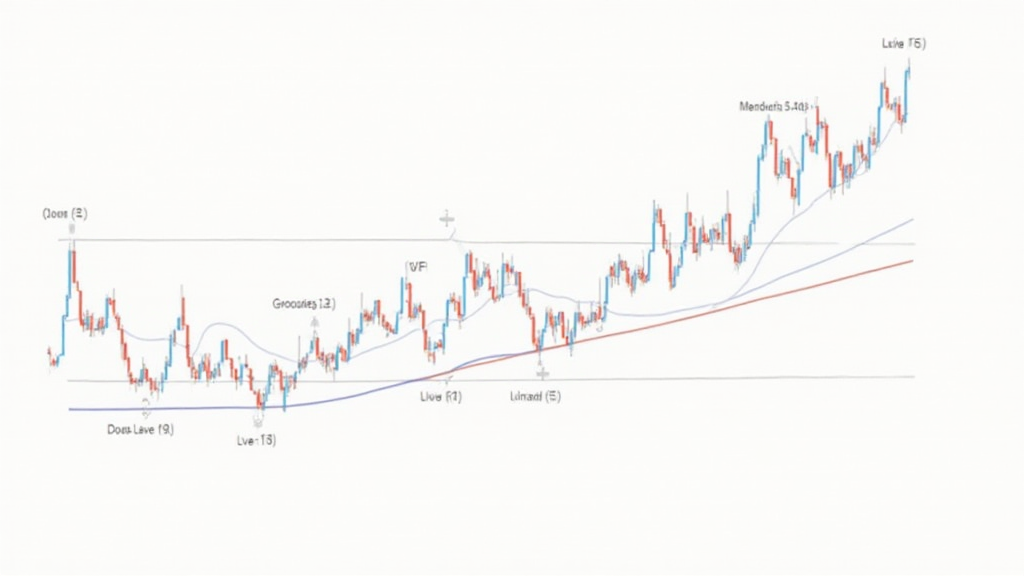

- Charts and Patterns: Price charts are a fundamental part of technical analysis. Learning to read these charts can help you identify key market trends.

- Indicators: Various indicators like RSI, MACD, and moving averages help traders understand market sentiment.

As blockchain enthusiasts in Vietnam witness a rapid growth rate in cryptocurrency adoption, understanding these basics becomes increasingly crucial. Tiêu chuẩn an ninh blockchain plays a vital role in this journey.

Essential Tools for Technical Analysis

To effectively perform crypto technical analysis, you’ll need a set of reliable tools. Here’s what experts recommend:

- TradingView: A popular charting tool that offers a variety of indicators and chart types.

- CoinMarketCap: Provides real-time market data and portfolio tracking.

- Crypto Pro: An all-in-one crypto tracking app.

These tools give you a comprehensive view of the market, assisting in making educated decisions.

Chart Patterns and Their Significance

Recognizing chart patterns is critical in technical analysis. For instance, bullish patterns indicate potential upward movement:

- Head and Shoulders: Suggests a reversal trend.

- Double Bottoms: Often signals a bullish trend.

Conversely, bearish patterns might indicate a downturn, such as:

- Ascending Triangles: Can signify an upcoming price drop.

- Bear Flags: Usually precede a downward downturn.

Understanding these patterns can greatly increase your chances of success in predicting market movements.

Analyzing Market Sentiment

Market sentiment can significantly impact price actions. Analyzing social media trends, news articles, and overall market buzz can provide insights into the current sentiment. With a 45% increase in social media mentions for altcoins in Vietnam, tapping into local sentiment can guide your investment strategies.

Strategies for 2025: Focusing on Promising Altcoins

As you navigate through technical analysis, focusing on the most promising altcoins is vital. In 2025, potential candidates include:

- Decentralized Finance Tokens: Particularly those contributing to lending and yield farming.

- Layer-2 Solutions: These can address scalability issues in blockchain.

- Environmentally Friendly Cryptos: Consider green tokens that reduce energy consumption.

By considering these emerging altcoins and applying technical analysis, you can position yourself advantageously in the coming year.

DeFi Vulnerabilities and Risk Management

Despite the promise of DeFi, vulnerabilities still loom large. Strategies to mitigate risks include:

- Regular Auditing: Ensure smart contracts are audited frequently. Kiểm toán hợp đồng thông minh can minimize exposure.

- Diversification: Avoid putting all your investments into one project.

Staying informed on vulnerability disclosures can save you from potential losses.

Mental Framework: Staying Resilient Amid Volatility

The crypto market is notorious for its price swings. Ensuring you remain psychologically prepared for these fluctuations can help maintain your investment strategy:

- Stay Educated: Continuously educate yourself on market dynamics.

- Develop Clear Objectives: Set realistic profit and loss thresholds.

It’s essential to trust your analysis while keeping emotions in check.

Conclusion: Embracing Crypto Technical Analysis

The future of cryptocurrency investment hinges on our ability to adapt to market changes and hone our technical analysis skills. By understanding the intricacies of market movements and employing effective strategies, you can position yourself for success in 2025. Keep monitoring trends, invest wisely, and most importantly, utilize the power of crypto technical analysis to navigate this exciting digital landscape.

For further insights and comprehensive guides on the cryptocurrency market, visit bobscoinsonline.